BlackBerry Ltd Stock has been a prominent name in the tech industry, transitioning from a leader in mobile hardware to a software-centric company. This transformation has drawn attention from investors eager to evaluate the company’s financial stability and growth potential. At Stock Target Advisor, we examine BlackBerry’s latest earnings reports to provide insights into its stock forecast and what the numbers mean for investors.

Financial Highlights from BlackBerry’s Recent Earnings

The annual income statement for the fiscal year ending February 29, 2024, reveals key metrics that shed light on BlackBerry’s financial health. Below, we analyze the critical components:

Operating Revenue

BlackBerry Ltd. (BB:CA) reported operating revenue of CAD 0.85 billion for 2024, marking a significant improvement over the previous year’s CAD 0.66 billion. This increase highlights the company’s ability to recover and grow, particularly through its focus on software and cybersecurity services. Compared to fiscal 2022’s CAD 0.72 billion, the latest figures suggest a steady upward trajectory.

Earnings Before Interest and Taxes (EBIT)

The company’s EBIT stood at CAD -72.00 million in 2024, an improvement compared to the CAD -0.22 billion reported in 2023. While still negative, this narrowing of losses reflects ongoing efforts to streamline operations and enhance profitability. It’s a positive signal for stakeholders closely monitoring BlackBerry’s ability to turn its finances around.

Net Income

Net income was reported at CAD -0.18 billion in 2024, a marked improvement from the previous year’s CAD -0.73 billion. This metric underscores the company’s progress in managing expenses and optimizing operational efficiency. However, the consistent losses indicate that achieving profitability remains a challenge.

Free Cash Flow

Free cash flow for 2024 improved to CAD -24.00 million, compared to CAD -57.00 million in 2023 and CAD -67.00 million in 2022. This trend reflects BlackBerry’s focus on bolstering liquidity and managing its cash burn effectively.

Strategic Insights for Investors

The financial data points to both opportunities and challenges for BlackBerry investors. Here’s what the numbers suggest:

Revenue Growth Signals Recovery

The growth in operating revenue underscores BlackBerry’s success in capitalizing on its core segments, including cybersecurity and Internet of Things (IoT) solutions. These areas are expected to drive further growth as the company cements its foothold in high-demand industries.

Narrowing Losses Reflect Cost Management

The reduction in EBIT and net income losses signifies improved cost management and a strategic focus on high-margin operations. These efforts are critical for BlackBerry to achieve long-term financial stability and profitability.

Liquidity Improvements Are Promising

While free cash flow remains in negative territory, the year-over-year improvement is a promising development. It suggests that BlackBerry is taking meaningful steps to address its cash flow challenges and enhance operational efficiency.

BlackBerry’s Core Business Segments: A Breakdown

Understanding BlackBerry’s primary revenue drivers can help investors assess its future potential. Here’s a closer look at its core business segments:

1. Cybersecurity Solutions

Cybersecurity remains a cornerstone of BlackBerry’s operations. With increasing global cyber threats, demand for advanced security solutions is at an all-time high. BlackBerry’s AI-driven cybersecurity products, such as Cylance, position the company as a leader in this space.

2. Internet of Things (IoT)

BlackBerry’s IoT segment leverages its expertise in secure communications to develop cutting-edge solutions for connected devices. The company’s QNX platform, widely used in automotive systems, is a significant revenue contributor.

3. Licensing and Intellectual Property

BlackBerry’s extensive portfolio of patents and intellectual property continues to generate licensing revenue. This segment provides a steady income stream and underscores the company’s innovation legacy.

Challenges Facing BlackBerry

Despite the positive trends, BlackBerry faces several challenges that investors should consider:

1. Intense Competition

The cybersecurity and IoT markets are highly competitive, with numerous established players vying for market share. BlackBerry’s ability to differentiate itself will be critical to sustaining growth.

2. Profitability Concerns

While losses are narrowing, BlackBerry has yet to achieve consistent profitability. This remains a significant concern for investors seeking long-term value.

3. Market Perception

The company’s transition from hardware to software has been met with mixed reactions. Rebuilding its brand image and investor confidence will be essential for future success.

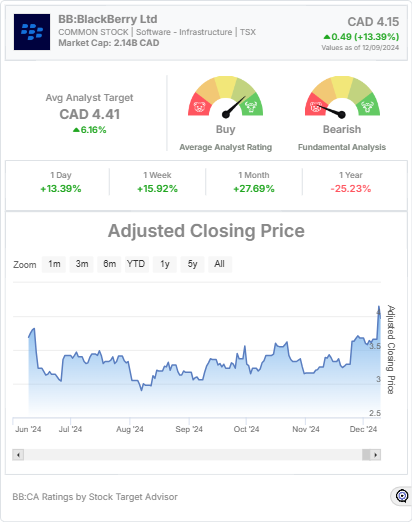

Analyst Perspectives on BlackBerry Stock

At Stock Target Advisor, we analyze market trends and expert opinions to gauge BlackBerry’s stock potential.

Bullish Outlook

Optimists highlight BlackBerry’s strong position in the growing cybersecurity and IoT markets. The company’s strategic partnerships and innovative product offerings are viewed as key growth drivers.

Bearish Concerns

Skeptics point to the persistent losses and cash flow challenges as significant risks. They emphasize the need for BlackBerry to demonstrate consistent profitability before its stock can realize substantial gains.

Future Projections for BlackBerry Stock

Based on recent earnings and market trends, here are some potential scenarios for BlackBerry’s stock:

Growth Scenario

If BlackBerry continues to grow its software revenue and improve operational efficiency, its stock could see significant appreciation. Success in expanding its cybersecurity and IoT segments will be pivotal.

Risk Scenario

Failure to achieve profitability or address market competition could lead to stagnant or declining stock performance. Investors should monitor quarterly results closely to assess the company’s progress.

Conclusion

BlackBerry Ltd’s recent earnings reports reveal a company making strides toward recovery but still grappling with challenges. The improvements in revenue, EBIT, net income, and free cash flow are encouraging signs, but achieving consistent profitability remains a hurdle.

At Stock Target Advisor, we believe BlackBerry’s strategic focus on cybersecurity and IoT holds promise for long-term growth. However, investors should approach with caution and keep an eye on upcoming financial updates to gauge the company’s trajectory.

For more in-depth insights, check out our analysis of financial news to stay ahead in the market.